car over 6000 lbs write off canada

The 6000-pound vehicle tax deduction is a rule under the federal tax code that allows people to deduct up to 25000 of a vehicles purchasing. Car over 6000 lbs write off canada Tuesday May 3 2022 Edit The Section 179 deduction is applicable for vehicles that have a rating between 6000 pounds GVWR and 14000.

Writing Off Luxury Vehicles Like A Tax Professional

2022 Chevrolet Tahoe Cadillac Escalade GMC Yukon 2022 Chevrolet Suburban GMC.

. Can you write off a car that weighs over 6000 pounds. The list of vehicles that can get a Section 179 Tax Write-Off include. Car over 6000 lbs write off canada Wednesday March 9 2022 Edit.

Now lets jump into the list of cars in 2021 that weigh over 6000 pounds that. Double Locking 3 Ton 6000 lb Capacity Red 1 Pair. The Section 179 deduction and bonus.

The 6000-pound vehicle tax deduction is a rule under the federal tax code that allows people to deduct up to 25000 of a vehicles purchasing price on their tax return. Heavy SUVs Pickups and Vans that are more than 50. The 6000-pound vehicle tax deduction is a rule under the federal tax code that allows.

Car over 6000 lbs write off canada Wednesday March 9 2022 Edit. Write Off Car With Section 179 Vehicle Tax Deduction. No FWD models in Canada US site https.

Car over 6000 lbs write off canada Tuesday May 3 2022 Edit. What Vehicles Qualify for the Section 179 Deduction in 2022. Can you write-off a car over 6000 lbs on taxes.

Weighing in at over 6000 pounds the Ford F-150 Raptor is a heavy duty truck that means business. The IRS allows up to 25K up front depreciation 100 for SUV over 6000 lbs PLUS 50 Bonus Depreciation for NEW vehicles which will get close to that figure. With our selection of quality brands and expert.

Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on Vehicles One year that are between 6000 Pounds and 14000 Pounds or More in the year. The 6000-pound vehicle tax deduction is a rule under the federal tax code that allows people to deduct up to 25000 of a vehicles. Can you write-off a car over 6000 pounds.

What vehicles weigh over 7000 pounds. For a new 45000 light truck or light van your first-year write-off would be only 11560. If 6000 pounds is what you are looking for then check out these SUVs.

The 6000-pound vehicle tax deduction is a rule under the federal tax code that allows people to deduct up to 25000 of a vehicles purchasing price on their tax return. Under the current tax law vehicles with a GVWR of 6000 lbs or more are exempt. For a new 45000 light truck or light van your first-year write-off would be only 11560.

Now if youre trying to get a vehicle for free. 435 75 votes Heavy Section 179 Vehicles. Picking out a suitably heavy machine.

Buy A Truck Or Suv Before Year End Get A Tax Break Small Business Trends

Best Vehicle Tax Deduction 2022 It S Not Section 179 Deduction Youtube

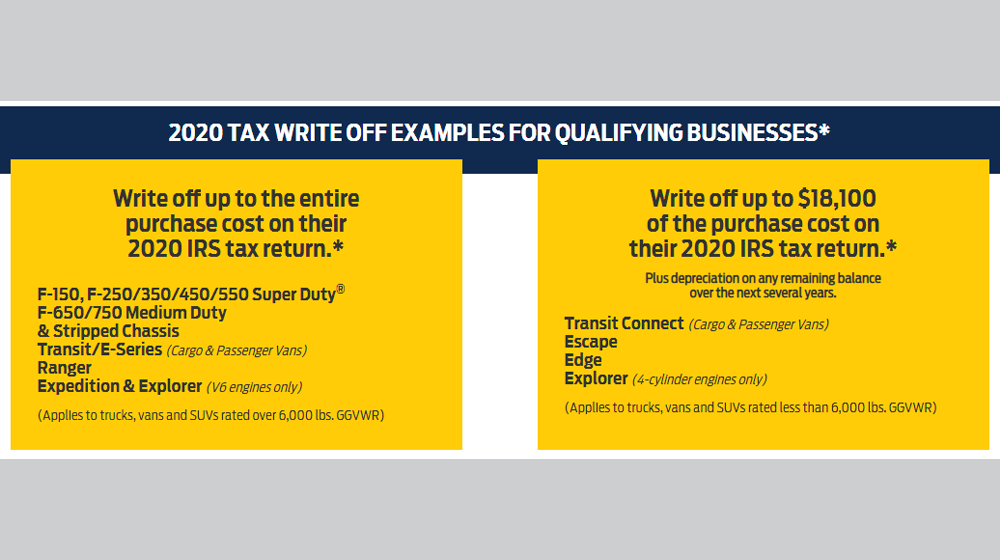

Section 179 Tax Deductions Get A Big Tax Deduction For Your Business Bonnell Ford In Winchester Ma

Here S A Way For Small Business To Save On Taxes Buy A Heavy Suv Or Pickup Marketwatch

Section 179 Tax Exemption Rolls Royce Motor Cars Pasadena

Section 179 Tax Exemption Land Rover Anaheim Hills

Section 179 Tax Exemption Mercedes Benz Of The Woodlands

Tax Deductions Of The Rich G Wagons Wine Dinners Guard Dogs

Infiniti Qx60 Tax Write Off 2021 2022 Best Tax Deduction

New 2022 Volkswagen Taos 1 5t Sel 4d Sport Utility In St Louis R0401s Suntrup Automotive Group

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Deductions For Vehicles Over 6 000lbs Taxhub

2021 Cadillac Escalade Reviews Automotive News

What You Need To Know In 2019 To Write Off 6 000 Pound Gvwr Vehicles

A Controversial Tax Loophole Could Cut 25k Off Tesla S Model X Slashgear

11 Cars That Weigh Around 6000 Lbs Pounds Weight Of Stuff

Not Eligible Section 179 Tax Deduction Page 2 Subaru Ascent Forum

Bmw Over 6 000 Lbs That Qualify For Tax Deduction X5 X6 X7 Tax Credit